- Pledge 1% Community

- Learn

- Blog

- Event Roundup–Pledge 1%: Business as a force for g...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Email to a Friend

- Printer Friendly Page

- Report Inappropriate Content

Event Roundup–Pledge 1%: Business as a force for good at Collision Conference!

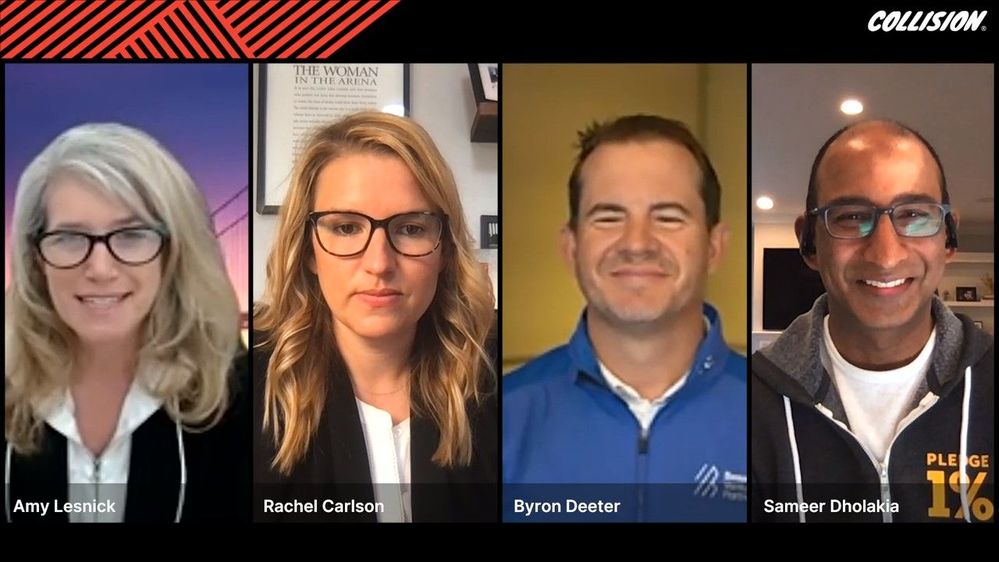

To find out why pledging equity is not only the right thing to do but also the smart thing to do to drive your company’s success, Midas List VC Byron Deeter of Bessemer Venture Partners, and top CEOs Rachel Carlson of Guild Education and Sameer Dholakia of SendGrid joined us to discuss how companies can leverage their assets to support their communities. In case you missed our session at Collision, below is an overview of the discussion.

You can download the Pledge 1% CEO Equity Playbook here.

Everything we’ve all experienced over the last year – health, economic, social justice crisis – has spotlighted the interconnectedness of our world. We’ve come to realize that corporate success is deeply intertwined with the well-being of our employees, customers, suppliers, as well as the communities where we live and operate. While it was demonstrated that the toughest issues of our time can’t be solved by governments and nonprofits alone, we at Pledge 1% together with member companies acknowledge that we have an important and necessary role to play in making a positive contribution. And it’s a role that is increasingly an expectation of employees, partners, customers, and even investors.

Setting aside equity for social impact is rapidly becoming the norm in a world where companies are stepping up and filling the gap to solve the most pressing issues of our time. In the last few years, Pledge 1% companies have ignited over a billion dollars of new philanthropy, and we believe in empowering CEOs to make a broader impact on their company culture and use their businesses as agents of change.

Here are our 3 takeaways why you should consider setting aside equity for social impact:

- The hottest, most successful companies are doing this. Increasingly, this has been a critical component for IPO readiness. Atlassian, Twilio, Okta, Slack, DocuSign, PagerDuty, SendGrid, Zuora, Unity, Auth0, Gainsight, Upwork – all set aside equity on their road to IPO or prior to their acquisitions. Many hot pre-exit companies including Canva, Guild Education, Lookout, Skilljar, Puppet, and Crunchbase have also shown leadership in getting this done.

- Top VCs already support this. As leaders of the company, CEOs set the direction strategically and Pledge 1% presents another opportunity to lead. Top venture capitalists have already supported their portfolio companies in formalizing their social impact equity commitments, so it really comes down to the CEOs wanting to advocate for this and believing that it’s important.

- The force multiplier effect of this movement can be tremendous. As your valuation or stock price goes up, so does your social impact fund. Contributing through paying taxes is on a linear or flat line, while equity has an exponential curve to it as it grows along with your company’s success.

In collaboration with top CEOs from a variety of industries, Pledge 1% has published a new, comprehensive CEO Equity Playbook, which outlines how companies of any size can set aside equity to fund social impact initiatives. This invaluable resource includes tips on how to garner board support, examples of the different types of equity models, and case studies from leaders such as Twilio, Crunchbase, and more.

Missed the event? That’s OK – you can watch the recording here:

Originally posted: May 4th, 2021

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

1% Equity

9 -

1% Product

4 -

1% Profit

4 -

1% Time

5 -

Article Campaign

29 -

Big Impact

2 -

Cloud 100

5 -

Equity Pledge

1 -

Events

1 -

impact report

14 -

Member Announcements

145 -

Member News

1 -

Member Stories

200 -

News

143 -

Pledge 1% Gives

428 -

Pledge to Preserve

4 -

reports

1 -

Resources

15 -

Small Biz

1 -

small business

1 -

Women Who Lead

356

- « Previous

- Next »

- Volunteering: The Ultimate Corporate Wellness Hack in Pledge 1% Blog

- Niki Adams: Balancing Life, Service, and Corporate Responsibility in Pledge 1% Blog

- Norah Perez: Advocating for Authenticity, Empowerment, and Inclusion in Leadership in Pledge 1% Blog

- Jayne Warrilow: Embracing Curiosity and Social Impact in Leadership in Pledge 1% Blog

- Unit 6: Maximize your impact in Make an Equity Pledge