Written by Pledge 1% and Andy Fyfe, Manager of B Corp Growth and Activation for B Lab U.S. & Canada. Originally published on bthechange.com

As a global community, we continue to face insurmountable challenges — from the pandemic to recent protests calling for racial justice to increased urgency surrounding climate change and more. This is only proving how companies can be on the frontlines, leveraging their time, talent, and resources to build solutions. Now more than ever, companies are seeking opportunities to build their social impact programs and ensure that they are equipped to tackle the biggest issues of the day.

However, for many companies — both early- and late-stage— donating time, money and resources can be difficult. Pledging equity is an easy and effective way for companies to play an active role in addressing these issues without having to worry about immediate upfront costs.

In the last four years, Pledge 1% members have ignited more than $500 million in new philanthropy by pledging equity.

What’s more, today’s investors, customers and employees are seeking organizations that are committed to creating positive change in their communities. In the war for talent and customers, a company that prioritizes social impact differentiates itself from competitors.

“In the first quarter of 2020, companies identified as having strong environmental, social and corporate governance principles outperformed traditional offerings, in part due to their lower exposure to the energy sector as oil prices crashed. The results come amid debate that ‘shareholder primacy’ is nearing its end as ‘stakeholder capitalism,’ where equal value to all stakeholders including customers, employees and suppliers takes hold,” explains Jon Hale of Morningstar. “It’s very simple, really — companies truly focused on the well-being of their workers and customers are able to make the right decisions more quickly in a major crisis like this one.”

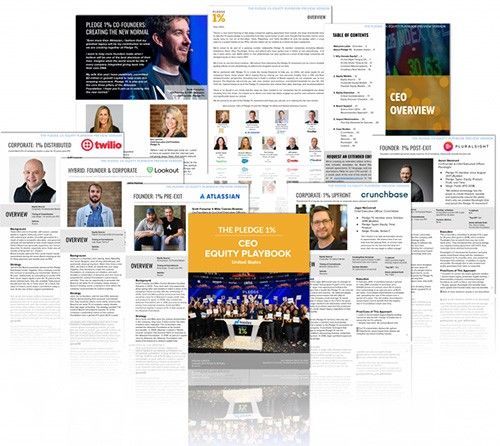

In collaboration with top CEOs from a variety of industries, Pledge 1% has published a new, comprehensive CEO Equity Playbook, which outlines how companies of any size can set aside equity to fund social impact initiatives. This invaluable resource includes tips on how to garner board support, examples of the different types of equity models, and case studies from leaders such as Twilio, Crunchbase, and more.

Pledge 1% CEO Equity Playbook.

“You can’t expect others to step up to make the change you desire,” says Pledge 1% Chief Executive Amy Lesnick. “Pledging equity gives you the reins and allows your company to be a key part of that change. It can help ensure your impact in the long run, helping you build a company culture and legacy that promotes a cohesive, inclusive environment for all.”

A new impact economy is being built, one where businesses prioritize and consider their impact on all the stakeholders they impact — including communities, workers, customers, and the environment. Download this free report to learn how the stakeholder model as practiced by B Corps is gaining global traction and validation.

In addition to Pledge 1%’s resources, B Lab has stewarded a community of Certified B Corporations proving that profit and mission do not need to be tradeoffs. Behind the certification, every B Corp has amended its legal charter to be accountable to all its stakeholders, not just its shareholders. Just how Pledge 1% has paved the way for fast-growing companies to embed equity for social impact, a wave of B Corps around the world are proving that doing good as a business is not a trend but the future.

Beyond company leadership, though, if we seek an inclusive and equitable economic system for all people and the planet, we need to make sweeping changes to policy. It is not simply individual actors that must change, but rather the system itself that must evolve so that extractive profits are no longer available to companies and investors. This month B Lab U.S. & Canada released its first policy white paper: From Shareholder Primacy to Stakeholder Capitalism.

“The disconnect between the needs of citizen-shareholders and the behavior of corporations has led to growing inequality and fueled an environmental emergency. We don’t need more evidence than what we’re seeing right now. And so we can no longer ask leaders to lead in a system with misaligned incentives and a culture with contrary norms. To see the systems change we seek we must shift culture and policy. That is what both Pledge 1% and B Lab are accomplishing.” Andy Fyfe, Manager of B Corp Growth and Activation for B Lab U.S. & Canada

Earlier this year Lemonade, an insurance company that is a B Corp and benefit corporation, in its S1 clearly stated that its fiduciary duty is expanded beyond just the financial return to its shareholders but to the well-being of stakeholders— unprecedented in a IPO.

“We believe values add value. Lemonade is a public benefit corporation, meaning that while we are about profit maximization over the long run, that is not all we are about. Our business decisions consider the greater good, and the value we are looking to create is measured in many currencies, money being but one of them. In any event, we reject the dichotomy between doing well and doing right.” Lemonade S1 (p. 117)

Today’s issues will not be solved by governments or nonprofits alone. Setting aside a portion of company equity today will ensure the business has a lasting impact tomorrow. Additionally, sharing program initiatives and best practices for how to create sustainable impact programs will help us all as we work to move forward together. Both B Lab and Pledge 1% are providing tools and frameworks to help companies of all sizes and stages navigate today’s issues and set themselves up for long-term impact.

Download the Pledge 1% CEO Equity Playbook to get started.

B The Change gathers and shares the voices from within the movement of people using business as a force for good and the community of Certified B Corporations. The opinions expressed do not necessarily reflect those of the nonprofit B Lab.