Business as a force for good is a top-of-mind topic. The last eighteen months have proven the power and the important role businesses have when it comes to tackling problems in our interconnected world. What it means to be a successful company has changed as leaders integrate ESG programs and other initiatives into their business DNA. This includes formalizing their equity pledge in advance of a liquidity event.

The shift is real and imminent. We’re seeing some of today’s hottest and most successful companies set aside equity before they reach IPO or acquisition, whereas more and more top VC firms are supporting this commitment to social good.

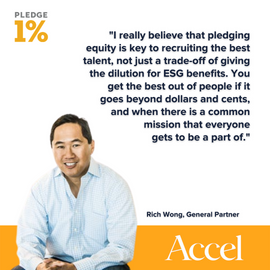

At this year’s SaaStr Enterprise, Pledge 1%’s CEO Amy Lesnick spoke with Rich Wong, General Partner of Accel, and CEOs Yvonne Wassenaar of Puppet and Dan Springer of DocuSign about their Pledge 1% strategies and how setting aside equity is not just the right, but the smart thing to do. Here are our 3 takeaways from the event:

- There is a moral imperative to help if you are in a position to support the communities you operate in. Companies – especially large ones or those in industries with larger stock and social value – have not only the ability but an obligation to make a positive impact on the world they are shaping.

- Giving back creates a company culture that attracts top talent who are proud to work with your mission and values. Economic incentives help attract top talent, but it’s the central drive and mission of a company that really brings people on board. Formalizing an equity pledge and joining Pledge 1% is a great way to attract people who are passionate about their work and excited to work at a place whose values they believe in.

- VCs and investors should support companies who pledge equity and integrate the Pledge 1% model into their business plans. This is a growing trend, and as more and more companies join Pledge 1%, an increasing number of investors are realizing the value of supporting founders who have this vision.

We also invite VCs and investors to email our team to learn more about our tools and program for investors!