- Pledge 1% Community

- Learn

- Knowledge Base

- Equity Donation: Case Studies and Insider Perspect...

- Article History

- Subscribe to RSS Feed

- Bookmark

- Subscribe

- Email to a Friend

- Printer Friendly Page

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Email to a Friend

- Report Inappropriate Content

on 06-14-2022 03:08 PM - edited on 06-21-2022 02:19 PM by Lindsey_P1

With increasing venture capital support and company adoption of the Pledge 1% 1-1-1 model, equity donation is becoming the new normal. Investors from top venture capital firms are joining the Pledge 1% Boardroom Allies and helping their high growth portfolio companies set aside equity to fund their corporate social impact programs.

But how did companies actually execute their equity pledge? And why are investors behind the movement? IVP Partner Jules Maltz compiled a panel, moderated by Pledge 1% CEO Amy Lesnick, of executives from DocuSign, Checkr, and Coinbase to weigh in with their learnings. Watch the video or read the recap below:

Why Donate Equity: The Social and Business Case

An equity donation allocates a portion of outstanding shares to be used to fund a company’s social impact program upon a liquidity event. From a business perspective, donating equity is both the right thing to do and the smart thing to do. As DocuSign CEO Dan Springer puts it, “Our economic power is a huge way we can affect impact.”

Substantial social good initiatives can also help attract and retain employees. “Companies are competing not just on their salaries and packages, but what they stand for,” IVP partner Jules Maltz shared, “It’s more important in today’s environment than ever.”

Dominique Baillet, VP of People at Coinbase, explains another benefit of equity donation: strengthening external partnerships. For example, when Coinbase started a marketing relationship with the NBA, they also used money from their equity donation to support the Kevin Durant Charity Foundation to deepen the relationship between the organizations.

Getting Board Support

As CEO of DocuSign and Board Member of multiple organizations, Dan Springer has seen equity donations from both sides of the table. Here is his advice:

- Find allies: Start by finding one like-minded board member to talk to, and then use their support to talk to others. Pledge 1%’s Boardroom Allies program can help you identify firms and investors that actively seek to help companies in this position.

- Be authentic, clear, and firm in your vision: Ask yourself why this action is important to the company as a whole. Stay firm in your commitment and make a compelling case.

- Convey a sense of urgency: Add a timeline to your decision and/or try to pair it with another significant event (ex. fundraising).

Checkr Co-founder and CEO Daniel Yanisse also advised tying the pledge to a fundraising event, and described how Checkr made the company’s equity pledge during their Series E round. “You have to do equity expansion for employees anyway,” he explains, “Why not incorporate an equity donation, as well?”

How to Donate Equity: The Models

There are multiple ways that companies can donate equity, but every organization must ask themselves two questions:

- Equity Source: Is my equity source coming from the corporation, founder(s), or a combination of both?

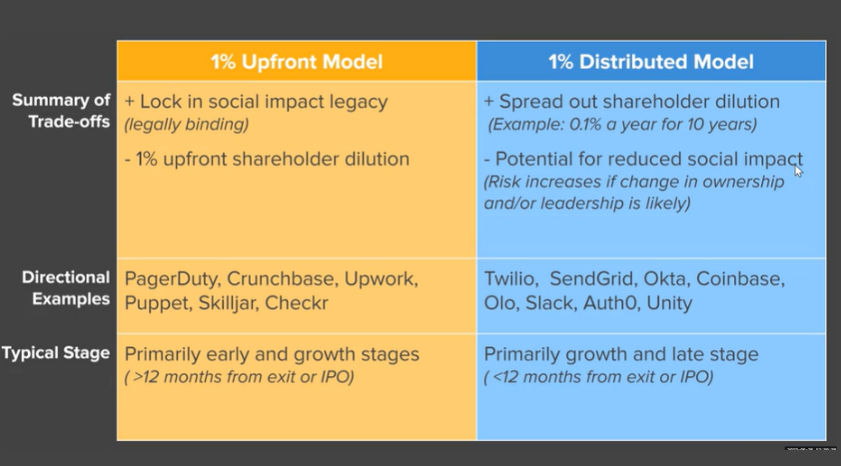

- Distribution: Will the equity be donated all at once (1% Upfront model) or in tranches over a certain period of time, eg. 20% per year over 5 years (1% distributed model)?

Every company will have a solution that works best for them. We’ve broken down a brief summary of the pros and cons below:

Want to learn more about models? Our equity donation 101 article and our CEO Equity Donation Playbook give much more detail.

Aligning Equity Donation with Corporate Mission

Many of the speakers advised aligning giving efforts with a corporate mission. Dan Springer summarized this advice by saying, “Figure out who you are, what your giving back is all about, and a rubric for communicating it.”

Since Checkr is a background check company, the company focuses their efforts on helping former convicts re-enter the workforce. “I wanted to choose a cause for core investment where we could make an outsized impact,” Yanisse explains. Their expertise, product, and relationships within the field can help them address this issue in a powerful way.

DocuSign also focuses their social good efforts on a cause that they directly impact: forest and environmental impact. Their paperless online contract product already greatly reduces the need for paper consumption, and they wanted to take their efforts to the next level. Their methods include both top-bottom and bottom-top initiatives: DocuSign invests in environmental causes, but also supports a substantial employee match donation program. They also reserve a portion of social impact funds to react to current events or crises, such as the COVID outbreak.

Case Studies & Additional Resources

Many Pledge 1% members shared their strategies and thought processes for equity donation. See the attached PDF below for more case studies or download The CEO Equity Playbook for a more in-depth examples.

Want more resources? Check out the links below. You can also email us directly at equity@pledge1percent.org

- Equity Donation 101 - A quick overview of how equity donation works, the models, and key decisions.

- The CEO Equity Playbook - A full guide to the equity models, case studies, and strategies for talking to your board.

- The CFO/General Counsel Companion Guide - A compilation of template legal documents for the equity models and FAQs for your CFO and legal team.

- Boardroom Allies Program - More information on our Boardroom Allies program where investors support equity donation. Email us at equity@pledge1percent.org for more information on how to join.

Playbooks are a Pledge 1% Member resource. Not a Member yet? Take the Pledge today for full access to the Pledge 1% tools & resources.