- Pledge 1% Community

- Learn

- Knowledge Base

- Equity Donation 101: How to Donate Equity

- Article History

- Subscribe to RSS Feed

- Bookmark

- Subscribe

- Email to a Friend

- Printer Friendly Page

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Email to a Friend

- Report Inappropriate Content

on

08-19-2021

01:46 PM

- edited on

07-24-2024

02:05 PM

by

![]() Michelle Fifis

Michelle Fifis

Equity Donation 101: How to Donate Equity

An equity donation solidifies your company’s commitment to social impact in a lasting way by helping you generate funds to support grant making for years to come. For a deeper dive, explore our Equity Learning Path.

*Please note that you must consult your legal and tax advisors before formalizing an equity pledge as every company’s situation may be different.*

Overview: What is Equity Donation?

An equity donation allocates a portion of your company’s outstanding shares to be used to fund social impact causes. You may donate the shares to a philanthropic partner, such as a Donor Advised Fund, create your own foundation, or simply reserve the shares for future issuance. When your company experiences a liquidity event, such as an acquisition or IPO, the shares that have been set aside become liquid and may be sold to fund grant-making activity.

Equity Source: Corporate, Personal, or Both?

You can choose to donate corporate or personal equity — or a combination of both! Corporate equity cements a company’s commitment to giving back, but requires board approval. Personal equity only depends on one person, but may not make the strong corporate statement that donating company equity provides.

Equity Vehicle: Warrants or Shares?

Next, you will need to decide the equity vehicle. You can donate warrants or shares. The big difference here is that warrant commitments are legally binding at the time that the warrant agreement is entered into and the warrant holder shows up on the cap table, diluting all existing investors equally at that time, but the company’s ability to take a tax deduction occurs when the warrant is exercised after the liquidity event.

With a share transfer, the company’s ability to take a tax deduction occurs when the shares are transferred to the philanthropic partner. The board may pass a board resolution reserving shares for future issuance, but the pledge does not become binding until the shares are actually issued and transferred. Consider whether your organization has identified a philanthropic partner and is able to make a binding commitment via a warrant agreement or wishes to maintain flexibility by reserving the shares and formalizing the transfer down the road.

Warrants require a legally binding Warrant Agreement that defines the recipient of the funds, or warrant holder. Companies can choose to give to their own foundation, to a nonprofit directly, or to a donor-advised fund (DAF) that will distribute the gift on the company’s behalf. Many choose a DAF for simplicity’s sake, as the philanthropic partner provides tax, accounting, and advice on grant making.

Shares entail issuing a Board Resolution to reserve 1% of shares for future issuance for social impact and then a transfer of shares. While the Board resolution is not legally binding, a Board Resolution is still a strong public-facing commitment to giving back.

Making the equity commitment early in a company’s life cycle is wonderful as it sends a message to the world that your company cares about giving back, but the social impact shares will be diluted with additional funding rounds , so you might consider adding a “topping off” clause to your Board Resolution to set additional equity pre exit. This clause ensures that your social impact commitment equals 1% fully diluted shares.

Distribution - Upfront or Distributed?

You can choose to formalize the equity immediately all at once (upfront), or over a period of years afterwards (distributed). One example of a distributed model is making a commitment to issue and transfer 0.1% annually over ten years, or 0.2% annually over five years.

The distributed model spreads out investor dilution over a period of time, and may increase your gift if the value of your equity increases. However, factors like a change in leadership, market volatility, or general company stability, may endanger the likelihood of your gift being executed.

The upfront model guarantees that your gift will be donated in full right away. Investor dilution is felt entirely upfront. You may instruct your philanthropic partner to sell the shares over a period of time via a scheduled sale, allowing you to ride the hopeful upside of your shares.

Future Plans: Change in Leadership?

Many companies choose to spell out what will happen to their equity donation should a change of leadership or acquisition occur. This planning can help solidify your commitment regardless of future events.

Comparison Charts

Here are a few charts from our CEO Equity Playbook (pg. 14-15) that can help you compare and contrast the different models:

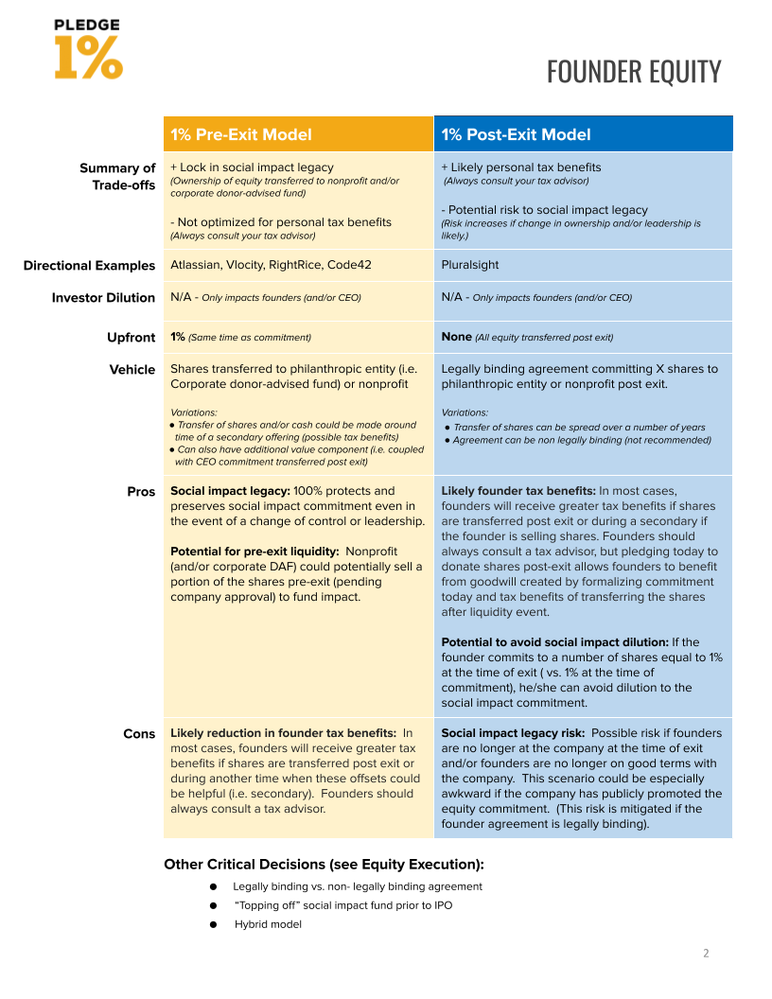

For Founder Equity Donations:

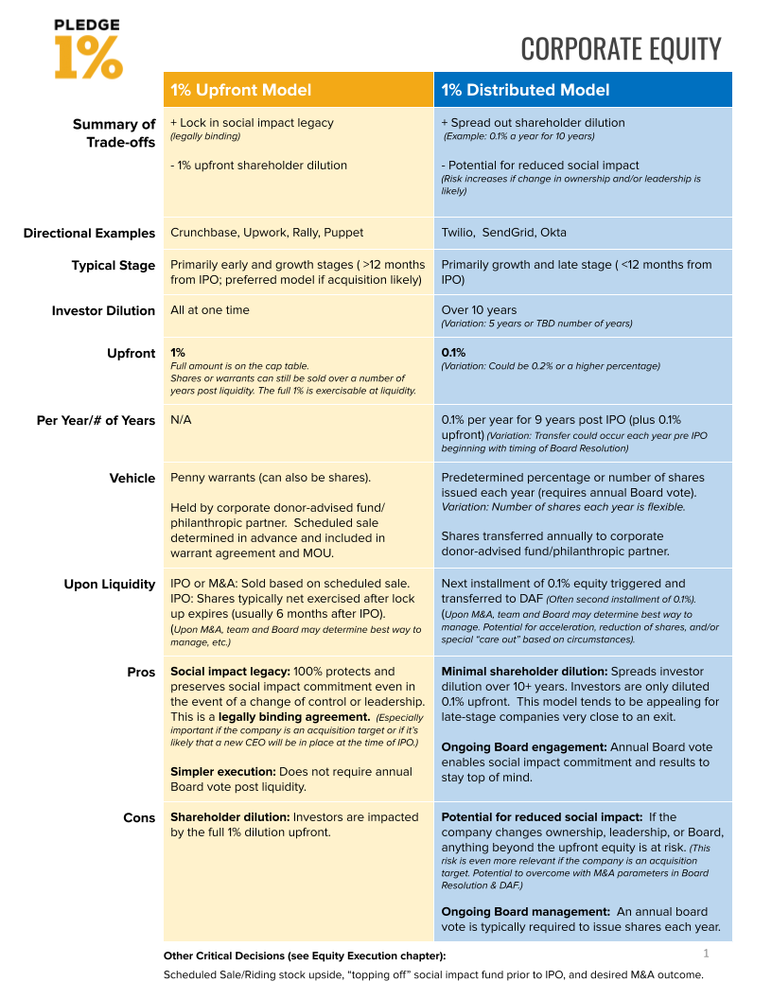

For Corporate Equity Donations:

Additional Resources

Pledging equity can be one of the most effective ways to have an impact and it is especially important now, as many companies are being forced to rethink their impact programs in the face of COVID-19.

As you move forward, our team is here to help guide you through this process and answer any questions you may have about the equity pledge. You can sign up here to join a special Zoom Office Hours with Jan D'Alessandro, our Equity Lead, who can share some best practices and next steps for your company. We encourage you to extend this invitation to your CFO, General Counsel, or other members of your team who may be involved in this process.

Already dozens of companies of all sizes and stages have worked with our team on formalizing their equity pledge. We are thrilled that you are interested in taking this next step for your company and are here to help as you set aside equity today to ensure your impact in the future.

Feel free to continue the conversation in the comments below or email equity@pledge1percent.org.

- The Equity Learning Path - Explore our equity donation guide and our equity case studies in this new Pledge 1% Learning Path.

- The CEO Equity Playbook - This playbook dives deeper into these questions and features case studies from large enterprises (ex. Atlassian, SendGrid). It also includes strategies for discussing equity donation with your board.

- The CFO/General Counsel Companion Guide - This document provides template legal documents for the models listed above and FAQs for your CFO and legal team.

Playbooks are a Pledge 1% Member resource. Not a Member yet? Take the Pledge today for full access to the Pledge 1% tools & resources.

- Airwallex named winner of 2025 Pledge 1% Impact Award in Pledge 1% Blog

- Airwallex Recognised as a Company of Good for Commitment to Corporate Purpose in Pledge 1% Blog

- Uniting for Change: A Resource for World Hunger Day 2025 in Engagement blueprints

- 5 steps to operationalize your profit pledge in Activate a Profit Pledge

- Profit pledge basics in Activate a Profit Pledge